Insurance premium calculation is like the ultimate math equation of the insurance world, determining how much you pay to stay protected. As we break down the complexities of this process, get ready to uncover the secrets behind pricing strategies that keep insurers in the game.

From actuarial methods to cutting-edge technology, we’ll explore the factors and innovations shaping insurance premiums today. So, buckle up and let’s take a ride through the world of insurance premium calculation.

Introduction to Insurance Premium Calculation

Insurance premium calculation is the process of determining the amount of money an individual or business needs to pay for their insurance coverage. It is a crucial step in the insurance industry to ensure that policyholders are adequately protected while maintaining the financial stability of the insurance company.

Accurately calculating insurance premiums is essential to prevent underpricing or overpricing of insurance policies. Underpricing can lead to financial losses for insurance companies, while overpricing can result in policyholders paying more than necessary for coverage.

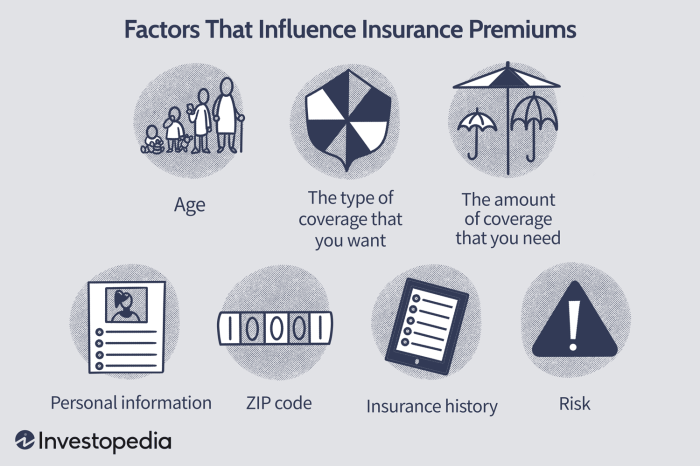

Factors Influencing Insurance Premium Calculations

- The type of insurance coverage: Different types of insurance, such as life insurance, health insurance, auto insurance, and property insurance, have varying risk factors that influence premium calculations.

- Policyholder’s risk profile: Factors such as age, gender, occupation, health status, driving record, and credit history can impact the premium amount.

- Claims history: A history of previous insurance claims can affect the premium, as policyholders with a higher likelihood of filing claims may be charged higher premiums.

- Location: The geographic location of the insured property or individual can also play a role in premium calculations, as regions prone to natural disasters or higher crime rates may have higher premiums.

Importance of Accurate Premium Calculation

Accurate premium calculation ensures that policyholders are charged a fair and reasonable amount for their insurance coverage, based on their individual risk factors. It helps insurance companies maintain financial stability and provide adequate coverage to their customers.

Methods Used in Insurance Premium Calculation

Actuarial methods play a crucial role in determining insurance premiums. These methods involve analyzing data, statistics, and probabilities to assess risk and set appropriate premium rates. Underwriters utilize these actuarial methods to ensure that premiums accurately reflect the level of risk associated with insuring a particular individual or property.

Assessing Risk to Determine Premiums

When determining premiums, underwriters carefully evaluate various factors to assess the level of risk involved. These factors may include the individual’s age, health status, occupation, location, and past insurance claims history. By analyzing these factors, underwriters can better understand the likelihood of a claim being filed and adjust premiums accordingly.

- Underwriters use actuarial tables and statistical models to quantify risk and predict the likelihood of future claims.

- Factors such as age, gender, and lifestyle habits are taken into account to determine the overall risk profile of the insured individual.

- Claims history and past insurance data help underwriters assess the potential frequency and severity of future claims.

Data analytics and technology have revolutionized the insurance industry, allowing for more accurate risk assessment and premium calculations.

Role of Data Analytics and Technology

In modern premium calculations, data analytics and technology play a significant role in refining the accuracy of risk assessment and premium setting. Insurers utilize advanced algorithms and predictive modeling tools to analyze vast amounts of data and identify trends that can help predict future claims.

- Big data analytics enable insurers to identify patterns and correlations that may not be apparent through traditional methods.

- Machine learning algorithms can analyze complex data sets to predict risks and potential losses more accurately.

- Telematics devices and IoT technology provide real-time data on insured assets, allowing for personalized pricing based on actual usage and behavior.

Factors Impacting Insurance Premium Calculation

When it comes to calculating insurance premiums, several factors come into play that can have a significant impact on the final cost. Let’s dive into how these different elements can influence your insurance premium.

Age, Gender, and Health History

Age, gender, and health history are crucial factors that insurance companies consider when determining your premium. Younger individuals typically pay lower premiums as they are seen as less risky to insure. Gender can also play a role, as certain health conditions may be more prevalent in one gender over another. Additionally, your health history, including pre-existing conditions and lifestyle choices, can impact the cost of your premium.

Type and Coverage of Insurance Policies, Insurance premium calculation

The type and coverage of insurance policies you choose will directly affect your premium. More comprehensive policies with higher coverage limits will generally come with higher premiums. For example, a basic auto insurance policy with minimal coverage will cost less than a comprehensive policy that includes additional protections like uninsured motorist coverage or rental car reimbursement.

Geographical Location and Environmental Factors

Where you live can also impact your insurance premium. Insurance companies consider factors such as crime rates, weather patterns, and natural disaster risks when calculating premiums. If you live in an area prone to hurricanes, earthquakes, or other environmental hazards, you may face higher insurance costs. Similarly, urban areas with higher crime rates may result in increased premiums for certain types of insurance.

Technology and Innovation in Insurance Premium Calculation

Artificial intelligence, telematics, IoT devices, and blockchain technology are reshaping the landscape of insurance premium calculations.

Artificial Intelligence Revolution

Artificial intelligence (AI) plays a crucial role in insurance premium calculations by analyzing vast amounts of data to assess risk factors accurately. AI algorithms can process data quickly and efficiently, leading to more precise premium quotes for policyholders.

Telematics and IoT Devices

Telematics and IoT devices have enabled insurance companies to personalize premium calculations based on individual behavior and usage patterns. By tracking real-time data such as driving habits, location, and vehicle performance, insurers can offer discounts to customers who exhibit safe practices.

Blockchain Technology for Transparency and Security

Blockchain technology ensures transparency and security in insurance premium calculations by creating a decentralized and tamper-proof system for storing and sharing data. This technology enhances trust between insurers and policyholders, as all transactions are recorded in a secure and transparent manner.