Car financing options open up a world of possibilities in the realm of acquiring your dream vehicle. From leasing to loans, buckle up for a ride filled with choices and decisions that can shape your car ownership journey.

In this guide, we’ll dive into the nitty-gritty details of different car financing options, helping you navigate through the maze of advantages, disadvantages, and factors to consider before sealing the deal.

Overview of Car Financing Options

Car financing refers to the various methods through which individuals can purchase a vehicle by spreading out the cost over time through loans, leases, or other financial arrangements.

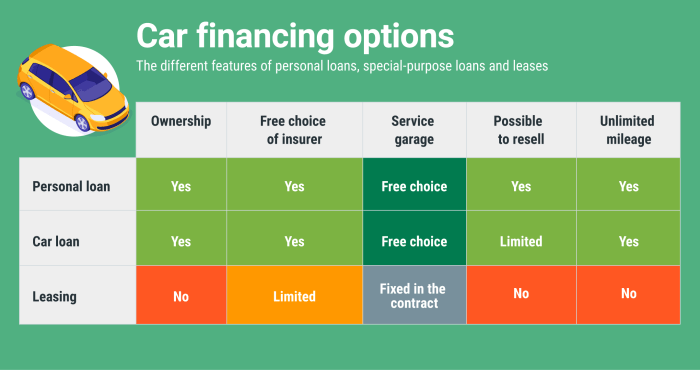

Types of Car Financing Options

- Auto Loans: This is a common way to finance a car where the buyer borrows money from a lender and pays it back over time with interest.

- Car Leases: With a lease, the individual pays a monthly fee to use the vehicle for a specific period, typically 2-3 years, without owning it outright.

- Dealer Financing: Dealerships often offer financing options through partnerships with banks or financial institutions, making it convenient for buyers to get a loan on the spot.

Importance of Understanding Different Car Financing Options

It is crucial for buyers to understand the various car financing options available to make informed decisions that align with their financial goals and preferences. By knowing the advantages and disadvantages of each option, individuals can choose the most suitable financing method that fits their budget and lifestyle.

Pros and Cons of Various Car Financing Options

When it comes to financing a car, there are several options available, each with its own set of advantages and disadvantages. Let’s take a closer look at the pros and cons of leasing a car, buying a car outright, and taking out a car loan.

Leasing a Car

Leasing a car can be a good option for those who like to drive a new vehicle every few years and prefer lower monthly payments. However, there are some drawbacks to consider. One major disadvantage is that you don’t own the car at the end of the lease term, and there can be mileage restrictions and penalties for excess wear and tear.

Buying a Car Outright vs. Financing

Buying a car outright means you own the vehicle outright from the start, without any monthly payments or interest charges. On the other hand, financing a car allows you to spread the cost over time, making it more affordable upfront. However, financing typically involves paying interest, which can add to the overall cost of the vehicle.

Taking Out a Car Loan

Taking out a car loan gives you the flexibility to purchase a car without having to pay the full amount upfront. This can be beneficial for those who need a vehicle but don’t have the cash on hand to buy one outright. However, car loans come with interest rates, and if you have a lower credit score, you may end up paying higher interest rates, increasing the total cost of the loan.

Factors to Consider When Choosing Car Financing

When deciding on car financing options, there are several key factors to take into consideration to ensure you make the best choice for your financial situation.

Interest Rates, Down Payments, and Loan Terms

- Interest Rates: The interest rate on your car loan will determine how much you pay in addition to the principal amount. Lower interest rates can save you money in the long run.

- Down Payments: The amount of money you can put down upfront will affect your monthly payments and the total cost of the loan. A larger down payment can reduce your overall loan amount.

- Loan Terms: The length of the loan will impact your monthly payments and the total interest paid. Longer loan terms may result in lower monthly payments but higher overall interest costs.

Impact of Credit Scores on Car Financing Options

Your credit score plays a significant role in the type of car financing options available to you. A higher credit score can qualify you for lower interest rates and better loan terms, while a lower credit score may result in higher interest rates and less favorable terms.

Personal Financial Goals and Car Financing

Consider your personal financial goals when choosing a car financing option. Whether you prioritize paying off the loan quickly, minimizing monthly payments, or minimizing overall interest costs, your financial goals will influence the best financing choice for you.

Tips for Securing the Best Car Financing Option

When it comes to securing the best car financing option, there are several strategies you can implement to ensure you get the most favorable terms and rates. From negotiating with lenders to improving your credit score, here are some tips to help you navigate the world of car financing.

Negotiating with Lenders for Better Terms

- Research the current interest rates offered by different lenders.

- Come prepared with information on your credit score and financial history.

- Be willing to negotiate on the interest rate, loan term, and down payment.

- Consider getting pre-approved for a loan to show lenders you are a serious buyer.

- Don’t be afraid to walk away if the terms are not favorable – there are always other options available.

Improving Credit Scores to Access Better Financing Options

- Pay off any outstanding debts and bills on time to improve your credit score.

- Check your credit report for errors and dispute any inaccuracies.

- Keep your credit utilization low by not maxing out your credit cards.

- Avoid opening new lines of credit before applying for car financing.

- Consider getting a co-signer with a strong credit history to increase your chances of approval.

Researching and Comparing Different Car Financing Offers

- Compare interest rates, loan terms, and fees from multiple lenders.

- Look for special promotions or incentives offered by car manufacturers or dealerships.

- Consider the total cost of the loan over the life of the term, not just the monthly payment.

- Read the fine print and ask questions about any terms or conditions you don’t understand.

- Use online tools and calculators to compare different financing options side by side.