With crypto staking rewards at the forefront, get ready to dive into the world of earning passive income in the crypto universe. From popular cryptocurrencies to maximizing rewards, this journey will unveil all the secrets you need to know.

Get ready to explore the ins and outs of staking rewards and how they can revolutionize your investment strategy.

Overview of Crypto Staking Rewards

Cryptocurrency staking rewards are incentives given to users who participate in the validation process of a blockchain network by holding their tokens in a staking wallet. These rewards are earned by users for locking up their coins to support network security and operations.

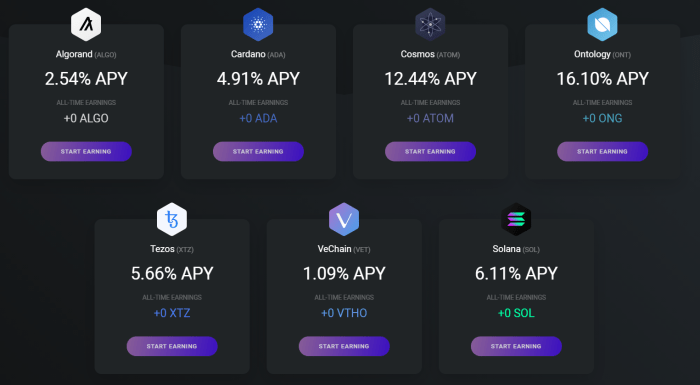

Popular Cryptocurrencies Offering Staking Rewards

- Ethereum (ETH): Ethereum allows users to stake their ETH to support the network and earn staking rewards.

- Cardano (ADA): Cardano’s Proof-of-Stake (PoS) model enables users to stake ADA and receive rewards for securing the network.

- Polkadot (DOT): Polkadot offers staking rewards to users who help secure the network by staking their DOT tokens.

Benefits of Staking Rewards in Crypto

- Passive Income: Staking rewards provide a passive income stream for crypto investors without the need for active trading.

- Network Security: Staking incentivizes users to hold and support the network, enhancing security and decentralization.

- Eco-Friendly: PoS consensus mechanisms used for staking require less energy compared to Proof-of-Work (PoW) models, making staking environmentally friendly.

Contribution to Blockchain Ecosystem

Staking rewards play a crucial role in the blockchain ecosystem by encouraging token holders to actively participate in network governance and security. By staking their tokens, users help maintain the integrity of the network, validate transactions, and contribute to the overall decentralization of the blockchain. This fosters a more robust and sustainable ecosystem for cryptocurrencies.

How to Earn Crypto Staking Rewards

To earn crypto staking rewards, individuals can participate in the process of staking cryptocurrencies, which involves holding funds in a cryptocurrency wallet to support the operations of a blockchain network. In return for providing this support, stakers receive rewards in the form of additional cryptocurrency.

Process of Staking Cryptocurrencies

Staking cryptocurrencies typically involves locking up a certain amount of coins in a wallet connected to the blockchain network. This helps secure the network and validate transactions. Stakers are then rewarded with additional coins for their contribution.

Requirements for Participating in Crypto Staking

1. Owning the cryptocurrency that offers staking rewards.

2. Having a compatible wallet that supports staking.

3. Meeting the minimum staking requirements set by the network.

4. Reliable internet connection for continuous participation.

Types of Staking Mechanisms

- Proof of Stake (PoS): Participants are chosen to validate blocks based on the number of coins they hold and are willing to “stake”.

- Delegated Proof of Stake (DPoS): Stakers vote for delegates to validate blocks on their behalf in this consensus mechanism.

- Masternodes: Participants run full nodes on the network and are rewarded for their service.

Risks Associated with Staking and Mitigation Strategies

Staking comes with risks such as slashing (penalties for malicious behavior), network attacks, and volatility in cryptocurrency prices. To mitigate these risks, stakers can diversify their holdings, choose reputable projects, and stay informed about network updates and security measures.

Factors Affecting Staking Rewards

When it comes to staking rewards in the world of cryptocurrency, several factors play a crucial role in determining the amount of rewards a staker can earn. Factors such as network participation, token price, staking duration, consensus algorithms, inflation rates, and network upgrades all have a significant impact on the rewards that stakers can receive.

Network Participation and Token Price

Network participation refers to the number of tokens being staked on a particular blockchain network. The higher the network participation, the lower the staking rewards due to increased competition. On the other hand, a decrease in network participation can lead to higher rewards as stakers have a greater chance of being selected to validate transactions and earn rewards. Additionally, token price plays a vital role in determining staking rewards. A higher token price means that stakers are earning more valuable rewards, while a lower token price can diminish the overall value of rewards earned.

Consensus Algorithms and Staking Rewards

Different cryptocurrencies utilize various consensus algorithms to secure their networks and validate transactions. These algorithms determine how staking rewards are distributed among network participants. For example, Proof of Stake (PoS) consensus algorithms typically offer staking rewards to participants based on the number of tokens they hold and stake, while Delegated Proof of Stake (DPoS) may involve voting mechanisms to select block producers who then receive rewards. Each consensus algorithm has its own set of rules and reward structures that impact the amount of rewards stakers can earn.

Inflation Rates and Network Upgrades

Inflation rates refer to the rate at which new tokens are introduced into circulation. Higher inflation rates can lead to a decrease in the value of staking rewards over time as the supply of tokens increases. Conversely, lower inflation rates may result in more valuable rewards for stakers. Network upgrades, such as changes to the staking mechanism or reward distribution, can also impact staking rewards. It is essential for stakers to stay informed about any upcoming upgrades or changes to the network that could affect their potential rewards.

Maximizing Staking Rewards in Different Market Conditions

To maximize staking rewards in different market conditions, stakers can employ various strategies such as diversifying their staking portfolios across multiple cryptocurrencies or adjusting their staking duration based on market trends. Stakers can also stay informed about network developments, inflation rates, and token prices to make informed decisions about their staking activities. Adapting to changing market conditions and staying proactive can help stakers optimize their staking rewards over time.

Staking vs. Other Passive Income Options

When it comes to earning passive income in the crypto space, staking is often compared with other methods like yield farming or lending. Each method comes with its own set of risks, liquidity considerations, and potential returns. Let’s dive into the comparison to understand how staking rewards stack up against other passive income options.

Comparing Risk and Liquidity

- Staking typically involves locking up your funds in a specific cryptocurrency network to support its operations and secure the blockchain. While this can be a relatively low-risk endeavor, it also means your funds are illiquid during the staking period.

- Yield farming, on the other hand, often involves providing liquidity to decentralized exchanges or protocols in exchange for rewards. This can expose you to smart contract risks and impermanent loss, making it a higher-risk, higher-reward option compared to staking.

- Lending allows you to earn interest on your crypto holdings by lending them out to borrowers. While this can provide a steady stream of income, it also comes with the risk of borrower default and platform insolvency.

Potential Returns and Diversification, Crypto staking rewards

- Staking rewards are generally more predictable and stable compared to yield farming, which can offer higher but more volatile returns. Lending falls somewhere in between, offering moderate returns with a level of risk management.

- By including staking rewards as part of your investment strategy, you can diversify your crypto portfolio and potentially reduce overall risk. This can help you navigate market fluctuations and optimize your passive income streams.

Scalability and Sustainability

- Staking rewards are often seen as a scalable and sustainable way to earn passive income in the long term. As more investors participate in staking, the network becomes more secure and rewards can increase, providing a continuous income stream.

- Compared to traditional investment options, staking offers a unique opportunity to earn rewards by actively participating in the growth of a cryptocurrency network. This can be particularly appealing to those looking for a more hands-on approach to investing.