Real Estate Investing Tips takes center stage, inviting readers into a world of financial opportunities and strategic decisions. Whether you’re a seasoned investor or just starting out, these tips will help you navigate the complex world of real estate investments with confidence and success.

From understanding different investment strategies to financing options and market trends, this guide will equip you with the knowledge needed to make informed decisions and maximize your returns in the real estate market.

Overview of Real Estate Investing

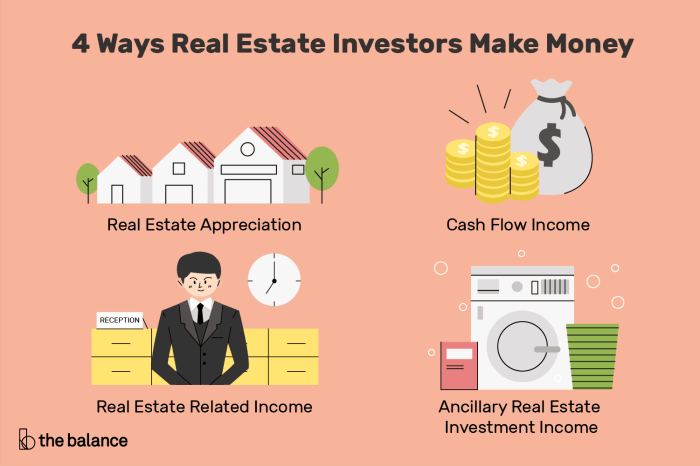

Real estate investing involves purchasing, owning, managing, renting, or selling properties for profit. It is a popular form of investment due to its potential for long-term growth and passive income opportunities.

Benefits of Investing in Real Estate

- Appreciation: Real estate properties tend to increase in value over time, providing potential for capital gains.

- Passive Income: Rental properties can generate regular income through rent payments.

- Tax Benefits: Real estate investors can take advantage of tax deductions, depreciation, and other tax benefits.

- Diversification: Real estate can be a valuable addition to an investment portfolio, offering diversification from traditional stocks and bonds.

Different Types of Real Estate Investments

- Residential Real Estate: Includes single-family homes, apartments, townhouses, and vacation rentals.

- Commercial Real Estate: Involves properties used for business purposes such as offices, retail spaces, and industrial buildings.

- Real Estate Investment Trusts (REITs): Publicly traded companies that own and manage income-producing real estate, allowing investors to access real estate markets without owning physical properties.

- Fix and Flip Properties: Involves purchasing properties below market value, renovating them, and selling for a profit.

Factors to Consider Before Investing

When diving into the world of real estate investing, there are several crucial factors to keep in mind to ensure a successful investment journey. From location to market conditions, each aspect plays a vital role in determining the profitability of your investments.

Importance of Location in Real Estate Investing

Location is often considered one of the most critical factors in real estate investing. A property’s location can significantly impact its value, rental income potential, and overall desirability. Investing in a prime location with easy access to amenities, good schools, and transportation hubs can lead to higher returns and increased demand from potential tenants or buyers.

- Properties in sought-after neighborhoods or areas with high appreciation rates tend to yield better returns over time.

- Consider factors like crime rates, proximity to commercial centers, and future development plans when evaluating a property’s location.

- Research local market trends and demographics to understand the demand and supply dynamics in different areas.

Market Conditions Impact on Real Estate Investments

Market conditions play a significant role in shaping the success of real estate investments. Fluctuations in the housing market, interest rates, and economic factors can influence property prices, rental rates, and overall investment performance.

- During a seller’s market, where demand exceeds supply, property prices tend to rise, making it an opportune time to sell for higher profits.

- In a buyer’s market, where supply exceeds demand, property prices may decrease, providing opportunities for investors to purchase properties at a lower cost.

- Keep an eye on interest rates, as higher rates can impact borrowing costs and affordability for both investors and homebuyers.

Strategies for Real Estate Investing

Real estate investing offers a variety of strategies to generate profits, each with its own unique set of risks and benefits. Understanding different investment strategies is crucial for making informed decisions and maximizing returns on your investments.

Rental Properties

- Rental properties involve purchasing real estate to rent out to tenants, generating a steady stream of rental income.

- Long-term investment strategy that can provide passive income and potential property appreciation over time.

- Risks include property maintenance costs, vacancy periods, and dealing with difficult tenants.

Fix and Flip

- Fix and flip strategy involves purchasing undervalued properties, renovating them, and selling at a higher price for a profit.

- Short-term investment strategy that requires active involvement in property renovation and sales process.

- Risks include unexpected renovation costs, market fluctuations, and potential delays in selling the property.

REITs (Real Estate Investment Trusts)

- REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors.

- Investing in REITs provides a way to diversify real estate holdings without directly owning properties.

- Risks include market volatility, interest rate changes, and overall economic conditions affecting REIT performance.

Financing Options for Real Estate Investments

Investing in real estate often requires substantial capital, and there are various financing options available to help investors make their purchase. Understanding the different sources of funding and their implications can play a crucial role in the success of your real estate ventures.

Traditional Bank Loans

- Traditional bank loans are a common financing option for real estate investments, offering competitive interest rates and terms.

- Pros: Lower interest rates, fixed repayment terms, and established lending processes.

- Cons: Stringent qualification requirements, longer approval times, and limited flexibility.

Private Lenders

- Private lenders are individuals or companies that provide capital for real estate investments outside of traditional banking institutions.

- Pros: Faster approval process, more flexibility in terms, and potential for creative financing solutions.

- Cons: Higher interest rates, shorter repayment terms, and less regulatory oversight.

Hard Money Loans

- Hard money loans are short-term, asset-based loans secured by the property itself, often used by real estate investors for fix-and-flip projects.

- Pros: Quick access to funds, minimal credit requirements, and focus on property value rather than borrower’s creditworthiness.

- Cons: Higher interest rates, shorter repayment terms, and higher upfront costs.

Using Leverage in Real Estate Investing

- Using leverage in real estate investing involves borrowing funds to increase the potential return on investment.

- Pros: Amplifies potential profits, allows investors to control more properties with less capital, and can enhance portfolio diversification.

- Cons: Increases risk exposure, higher debt obligations, and potential financial strain in case of market downturns.

Tips for Securing Financing, Real Estate Investing Tips

- Maintain a good credit score to improve loan eligibility and access better terms.

- Prepare a solid business plan outlining your investment strategy and projected returns.

- Shop around and compare different lenders to find the best financing options for your real estate investments.

- Consider working with a mortgage broker to explore a wide range of loan products and secure competitive rates.

Real Estate Market Trends

In the world of real estate investing, keeping a close eye on market trends is crucial for making informed decisions and maximizing returns on investments. Understanding the current market trends and their impact on investments is key to staying ahead in the game.

Impact of Market Trends on Investments

- Market trends can influence property prices, rental yields, and demand for certain types of properties.

- Being aware of market trends allows investors to capitalize on opportunities and avoid potential risks.

- Changes in market trends can impact the overall profitability and success of real estate investments.

Staying Updated with Market Trends

- Subscribe to real estate newsletters, follow industry experts on social media, and attend networking events to stay informed.

- Utilize real estate analytics tools and platforms to track market data and trends in specific locations.

- Regularly review reports and publications from reputable sources to gain insights into the latest market developments.

Economic Factors and Real Estate Market

- Factors like interest rates, employment rates, inflation, and GDP growth can significantly impact the real estate market.

- Changes in economic conditions can influence property values, rental prices, and overall market activity.

- Understanding how economic factors interact with the real estate market can help investors make informed decisions.

Property Management Tips: Real Estate Investing Tips

Managing rental properties effectively is crucial for real estate investors to maximize their returns and maintain the value of their investments. Property maintenance is also essential to ensure that the property remains attractive to potential tenants and retains its value over time. Finding reliable tenants is key to a successful rental property business, as they will help generate consistent rental income and take care of the property.

Tips for Managing Rental Properties Effectively

- Regularly inspect the property: Conduct routine inspections to identify any maintenance issues and address them promptly to prevent further damage.

- Screen tenants thoroughly: Perform background and credit checks on potential tenants to ensure they have a history of responsible behavior and can afford the rent.

- Establish clear communication: Maintain open lines of communication with tenants to address any concerns or issues they may have in a timely manner.

Importance of Property Maintenance in Real Estate Investing

“A well-maintained property not only attracts reliable tenants but also helps preserve the value of the investment in the long run.”

- Regular maintenance and repairs: Addressing maintenance issues promptly can prevent them from escalating into costly repairs in the future.

- Curb appeal: Maintaining the property’s exterior and landscaping can enhance its overall appearance and attract potential tenants.

Strategies for Finding Reliable Tenants

- Use online rental platforms: Advertise the property on reputable rental websites to reach a wide audience of potential tenants.

- Offer incentives: Offer move-in specials or discounts to attract quality tenants who are looking for a good deal.

- Ask for referrals: Encourage current tenants to refer friends or family members who are looking for a place to rent.